Nationwide Fixed Index Annuity Reviews

The New Heights annuity allows you to designate up to 70 of premium dollars to a uncapped SP 500 bi annual account. The rest of your money or the 30 will earn a flat fixed rate which is currently 1 fixed.

Best Fixed Index Annuity Companies Index Annuity Rates

This annuity offers 3 Balanced Allocation Strategy BAS options which are a blend of an equity indexed component based on SP 500 a declared rate.

Nationwide fixed index annuity reviews. With over 200 billion in annual sales the annuity industry. Nationwide has not endorsed this review in any way nor do we receive any type of compensation for providing this review. In fact the company boasts almost 2536 billion in total assets and has been in business for well over 85 years.

Also known as equity indexed annuities Nationwide fixed indexed annuities offer client growth potential capital preservation and lifetime income. Nationwide New Heights 10 Annuity Review. The most consistent fee youll come across with this annuity is the annual contract maintenance charge of 35 though this is waivable if your contract value is 50000.

The contract minimum is 25000. They have come out with a very attractive annuity with no caps. It gives you more growth potential than a fixed annuity but with less risk and less potential return than a variable annuity.

This nationwide new heights fixed index annuity review is meant to be an independent review at the request of readers so that they may see our perspective when breaking down the positives and negatives of this particular annuity. Nationwide New Heights 12 Annuity Highlights. According to the SEC some indexed annuities dont have a guaranteed interest rate so its important to review potential indexed annuities carefully and ensure you understand the terms and risks.

The annuity business has grown in popularity as investors especially those nearing retirement look for options to protect themselves from stock market volatility and give them a decent income stream in retirement. There are also 8 year 9 year and 10 year versions of this annuity. Nationwide Life Insurance Company is one of the largest insurance and annuity businesses in the US.

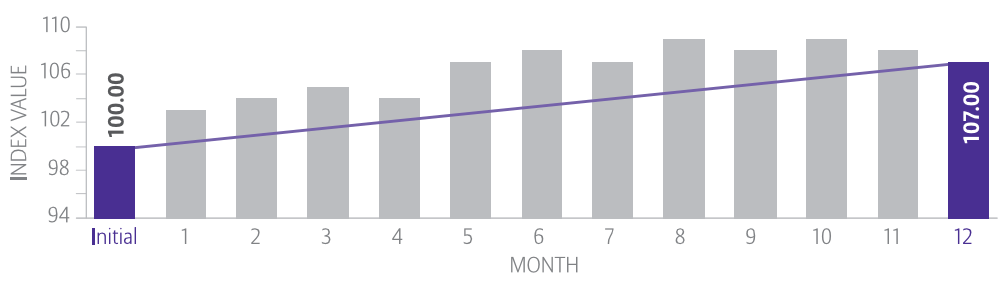

A fixed indexed annuity offers returns based on the changes in an underlying index such as the SP 500 Composite Stock Price Index. The Nationwide New Heights 12 Annuity is a fixed indexed annuity that can help you with building up your retirement savings through interest growth along with the protection of your principal. An impartial review of the Nationwide New Heights 9 Fixed Index Annuity.

Most fixed annuities take from the left hand and give with the right hand. An impartial review of the Nationwide New Heights 12 Fixed Index Annuity. Consistent steady growth in a variety of market environments.

Nationwide New Heights 12 Annuity Review The Nationwide New Heights 12 annuity is a Fixed Indexed annuity designed for growth and income. And as with other types of annuities that are offered in the market the funds that are inside of the annuitys account are able to grow on a tax-deferred basis which can allow the money to accumulate more quickly. Prospective investors can instead invest as little as 20000 but then the index participation rate drops to 140 with two-year crediting.

Nationwide Annuity Review. Nationwide New Heights 12 Fixed Indexed Annuity. Theres no shortage of annuity products available here as Nationwide offers variable fixed fixed indexed.

Morgan MOZAIC Index has delivered a 69 higher return than the SP 500The Nationwide New Heights Fixed Index Annuity is driven by the strength of this index delivering principal guarantee and upside. A fixed indexed annuity isnt a stock market investment nor does it directly participate in any stock or equity investment. A fixed indexed annuity is a tax-deferred long-term savings option that provides principal protection in a down market and opportunity for growth.

The Nationwide New Heights 10 annuity is a Fixed Indexed annuity designed for growth and income. Lets look at Nationwides New Heights Indexed Annuity. The annuity business has grown in popularity as investors especially those nearing retirement look for options to protect themselves from stock market volatility and give them a decent income stream in retirement.

Annuity company ratings are important to buyers because annuities arent backed by the federal government but rather by the insurance companies that issue them. By Cathy DeWitt Dunn. There are also 8 year 9 year and 12 year versions of this annuity.

Morgan MOZAIC Index Fixed Index Annuity. Nationwide New Heights gives with both hands and that is unique. Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances retirement planning and investments.

Saving for retirement is hard enough but another difficult. Indexed annuity contracts also offer a specified minimum which the contract value will not fall below regardless of index performance. The participation rate drops still further for those who want one-year crediting as is the case for 75000-plus investors but this is.

Since it was established in 2009 the JP. If you are comfortable with Certificate of Deposit CD-type returns then indexed annuities could work well in the principal-protected part of your portfolio. With over 200 billion in annual sales the annuity industry.

This is a single premium deferred fixed indexed annuity with surrender period of 10 years and excellent optional lifetime income and death benefit riders. Theres also a 130 core contract charge and investment option fees that can range from 053 to 241.

Another Record Setting Year For Indexed Annuities In 2019 Wink Insurancenewsnet

Best Fixed Index Annuity Companies Index Annuity Rates

Indexed Annuity Guide To Fixed Index Equity Index Annuities

An Impartial Review Of The Nationwide New Heights 9 Fixed Index Annuity